A unique legal system meticulously defines the essential elements of a will in Egypt. This system fuses the procedural framework of the Civil Code with the substantive principles of Islamic Sharia. Legally known as a Wasiya, a will allows an individual to direct the distribution of a portion of their assets after death. While the concept appears straightforward, strict regulations govern its application.

A Definitive Guide to the Essential Elements of a Will in Egypt

These deeply rooted regulations differ significantly from common law jurisdictions. Understanding these foundational elements represents more than an academic exercise; it is a critical necessity for anyone with assets in Egypt seeking to create a valid and enforceable will. Consequently, a failure to adhere to these principles can render a will void. This leaves the entire estate’s distribution to the default rules of forced heirship. At Alzayat Law Firm, our distinguished Egypt Inheritance Lawyers provide expert guidance. They ensure our clients’ final wishes remain legally protected and precisely executed.

Schedule Your Confidential Consultation – Secure Your Legacy Today.

Understanding the Legal Framework for the Elements of a Will in Egypt

A clear legal hierarchy underpins Egypt’s entire system of testamentary disposition. Specifically, this structure dictates how wills are created, interpreted, and executed, thus ensuring a predictable and orderly process. Therefore, for both Egyptian nationals and expatriates, a clear grasp of this framework represents the first step toward effective estate planning.

The Primacy of Law No. 71 of 1946: Core Requirements for a Will in Egypt

Law No. 71 of 1946, commonly known as the Law of Wills, governs the primary elements of a will in Egypt. This comprehensive legislation codifies, therefore, the principles of Islamic jurisprudence regarding bequests into a modern statutory format. Indeed, it serves as the definitive source for rules concerning the capacity of the person making the will. Furthermore, it defines the eligibility of beneficiaries and the limits on the assets a testator can bequeath.

This law formally establishes the core tenets of the Egyptian will, including the famous one-third rule and the general prohibition against making bequests to legal heirs. Its articles, moreover, provide the clear, black-letter law that Egyptian courts apply when validating or interpreting a will. Consequently, any will drafted for assets in Egypt must strictly comply with its provisions to achieve legal effectiveness and satisfy the requirements for a will in Egypt.

The Role of the Civil Code and Essential Parts of a Will in Egypt

While Law No. 71 of 1946 specifies the law for wills, it operates within the broader context of the Egyptian Civil Code and the overarching principles of Islamic Sharia. The Civil Code, for its part, provides the procedural architecture for administering an estate. This governs matters such as contract validity, property transfer, and the legal formalities required for official documents. For example, the rules for notarizing a will at the Real Estate Publicity Department (Shahr Aqari) fall under civil procedure.

Crucially, where the Law of Wills is silent on a particular issue, Egyptian courts must refer to the most preponderant opinion of the Hanafiyah School of Islamic Law. This mandate, therefore, ensures that the foundational principles of Islamic Fiqh continue to guide judicial interpretation. Thus, this maintains a direct link between modern legislation and its historical religious source. This dual framework, consequently, makes expert legal counsel indispensable for defining the essential parts of a will in Egypt.

The Critical Distinction: Elements of a will Components of an Egyptian Will vs. Forced Heirship

To fully appreciate the elements of a will in Egypt, we must first understand what a will is not. Unlike in Western legal traditions where a testator can dispose of their entire estate, the Egyptian system sharply distinguishes between a voluntary bequest (Wasiya) and mandatory inheritance (Mirath). This distinction is the bedrock of Egyptian estate planning.

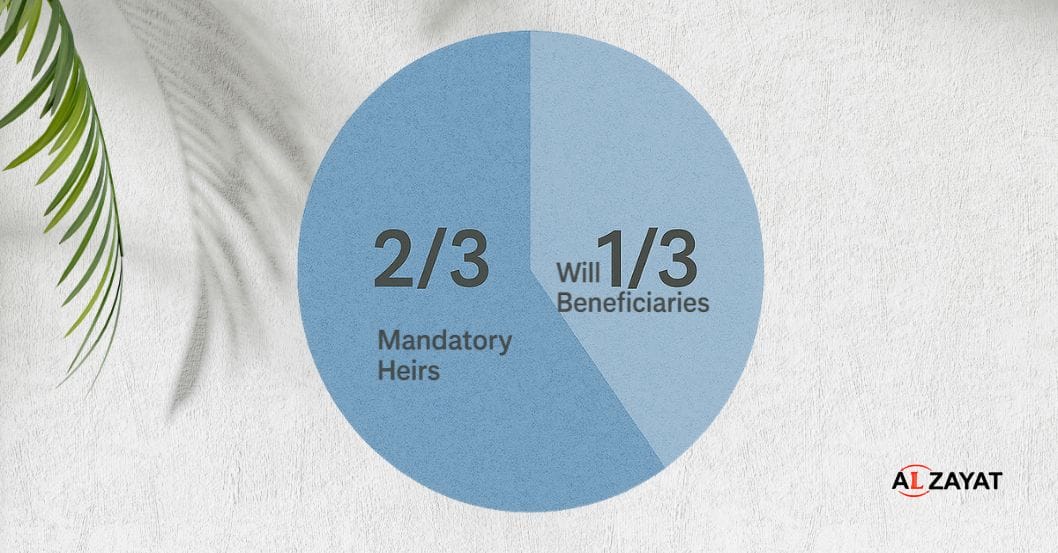

Mirath, specifically, refers to the system of forced heirship. Here, the law automatically allocates a significant portion of a deceased Muslim’s estate—typically two-thirds—to designated relatives in fixed, unalterable shares. This distribution, considered a divine mandate, cannot be modified by the deceased. Heirs, therefore, receive their shares automatically by operation of law, not through the testator’s generosity.

In contrast, a Wasiya constitutes a voluntary and discretionary legal act. It allows a testator, consequently, to dispose of up to one-third of their net estate to individuals who are not legal heirs. Therefore, the will operates only on this limited “discretionary third.” It serves as a tool for purposes such as charity, rewarding a loyal friend, or supporting a relative who does not qualify as a designated heir.

The Four Pillars of an Egyptian Will (Arkan al-Wasiya)

Four essential pillars, or Arkan, must support a will for it to be valid and enforceable in an Egyptian court. The absence or legal defect of any one of these core elements of a will in Egypt can render the entire document invalid. This subjects it to legal challenges that can ultimately defeat the testator’s intentions.

Pillar 1: The Testator – Vital Components of an Egyptian Will

The testator is the individual creating the will. To do so with legal effect, they must meet stringent requirements related to their legal and mental capacity. These rules, furthermore, ensure that the will represents a true and voluntary expression of the individual’s wishes. First, the testator must possess the legal capacity to make a donation.

In Egypt, this generally ties to the age of majority, which is 21 Gregorian years. Furthermore, the testator must be of sound mind at the moment of executing the will. Consequently, a will an individual creates while suffering from insanity, or one made under duress, coercion, or undue influence, is voidable. In such cases, a court can nullify these components of an Egyptian will.

Pillar 2: The Beneficiary – Key Requirements for a Will in Egypt

The beneficiary is the person or entity designated to receive assets under the will. Egyptian law, however, places significant restrictions on who can be a beneficiary to protect the integrity of the forced heirship system. Among these, the rule of “no will for an heir” (*La Wasiya Li Warith*) stands as the most critical.

Law No. 71 of 1946 codifies this principle. A will that bequeaths property to a person already a legal heir (such as a child, spouse, or parent) is generally invalid. This rule aims to prevent a testator from favoring one heir over another. Favoritism would effectively alter the legally mandated shares of inheritance (*Mirath*). However, an exception exists if all other legal heirs, themselves legally competent adults, unanimously consent to the bequest after the testator’s death.

Egyptian law, conversely, permits bequests to non-heirs. These can include friends, distant relatives not entitled to a forced share, or legal entities such as charities. Thus, understanding beneficiary eligibility is one of the key requirements for a will in Egypt.

Pillar 3: The Bequest – Essential Parts of a Will in Egypt

This element refers to the specific asset or property a testator transfers through the will. The aforementioned one-third rule, also known as the Thuluth rule, primarily limits the bequest. Accordingly, a testator may only dispose of a maximum of one-third of their net estate via a will. If a will purports to bequeath more than this fraction, the court does not automatically execute the excess amount.

Rather, the excess portion remains suspended. Instead, it becomes contingent on the unanimous consent of all legal heirs after the testator’s death. Furthermore, the bequest’s subject must be lawful (halal), and the testator must own it at the time of their death. Consequently, one cannot bequeath property that is illegal or does not belong to them. This limitation is one of the most essential parts of a will in Egypt.

Pillar 4: The Form – Finalizing the Elements of a Will in Egypt

The final pillar is the formulation, which refers to the will’s form and expression. While Islamic jurisprudence historically recognized oral wills in certain circumstances, modern Egyptian law has introduced practical requirements to prevent fraud and disputes. Under the Law of Wills, a will must exist in writing to be enforceable in court.

An oral will is legally perilous; courts will likely challenge it successfully. Furthermore, the written will’s language must be clear, unequivocal, and express a definitive intent to bequeath property after death. Ambiguous statements or mere suggestions do not constitute a valid will. Therefore, the assistance of skilled Egypt Estate Planning Solicitors proves crucial to meet this standard and finalize the elements of a will in Egypt.

Navigating the Procedural Elements of a Will in Egypt

Beyond the four substantive pillars, a will must also adhere to specific procedural formalities. This adherence ensures its validity and minimizes the risk of future legal challenges. Consequently, the method of documenting and registering a will constitutes one of the most critical procedural elements of a will in Egypt. Therefore, choosing the correct form becomes paramount to securing one’s legacy.

The Official (Notarial) Will: Meeting Requirements for a Will in Egypt

Egypt considers the official, or notarial, will the most secure and legally robust method for creating a will. This process involves drafting and signing the document before a Notary Public at the official Real Estate Publicity Department (Shahr Aqari). Typically, the procedure requires the presence of the testator and two witnesses.

Authorities register an official will as a public deed. This makes it exceptionally difficult to challenge on grounds of authenticity or forgery. It provides the highest level of legal certainty: it proves the testator’s signature is genuine, and they were of sound mind. Accordingly, Alzayat Law Firm, recognized by prestigious directories like The Legal 500, strongly recommends this method to satisfy the requirements for a will in Egypt.

The Customary (Urfi) Will: Risky Components of an Egyptian Will

A customary will, often called an Urfi or holographic will, is a private document a testator writes and signs without official notarization. For this type of will to have any chance of being upheld, it should be entirely in the testator’s handwriting and bear their signature. However, this form carries substantial risks.

Upon the testator’s death, any legal heir can simply deny the signature’s authenticity. This action, therefore, forces the will’s beneficiary to initiate a separate, often lengthy and costly, lawsuit to prove the signature’s validity (Da’wa Sihhat Tawqi). Consequently, if they cannot definitively prove the signature, the will becomes entirely void. Thus, reliance on these components of an Egyptian will is often discouraged.

The Sealed Will: Alternative Pillars of an Egyptian Will

A third, less common option is the sealed or secret will. In this procedure, the testator writes, signs, and seals the will in an envelope. The testator then deposits this sealed envelope with the Notary Public for safekeeping. While legally valid, in modern practice, however, they use this method infrequently compared to the official notarial will. The official will offers greater transparency and security from the outset, reinforcing the strong pillars of an Egyptian will.

Special Considerations for the Elements of a Will in Egypt for Foreigners

Foreign nationals with assets in Egypt operate at a complex intersection of international and domestic law. Therefore, understanding the specific elements of a will in Egypt as they apply to non-Egyptians proves crucial for protecting assets. While the legal framework provides certain allowances for foreigners, these are subject to important limitations.

The Conflict of Laws Principle and Requirements for a Will in Egypt

Article 17 of the Egyptian Civil Code establishes a critical principle for expatriates: inheritance and wills generally fall under the national law of the deceased. This provision, consequently, theoretically allows a foreign national to bypass Egypt’s forced heirship rules. They may distribute their entire estate according to their home country’s laws, which may permit complete testamentary freedom. Indeed, this principle forms a cornerstone of Egyptian Inheritance Law for Expatriates.

However, this principle is not absolute. For the will to be formally valid, it must meet the requirements of either the testator’s national law or the law of the country where they executed it. Therefore, all foreign documents must undergo proper legalization. This typically involves authentication by the Egyptian consulate, followed by professional translation. Adhering to these administrative requirements for a will in Egypt is mandatory.

The Public Policy Exception in Essential Parts of a Will in Egypt

A significant caveat, however, governs the application of a foreigner’s national law: it must not violate Egyptian public order or morality. While Egyptian courts have increasingly upheld foreign wills that dispose of an entire estate, Sharia’s mandatory shares sometimes constitute a matter of public policy. Consequently, this can lead to challenges, particularly if a will attempts to completely disinherit a close family member like a child.

Furthermore, for real estate located in Egypt, the principle of lex situs (law of the place) often applies. This means Egyptian law will govern the property’s transfer regardless of the owner’s nationality. Therefore, navigating these procedural hurdles requires the expertise of a Top International Law Firm in Egypt with a proven track record. This ensures all essential parts of a will in Egypt are respected.

In-Depth Analysis of Critical Limitations on the Elements of a Will in Egypt

Two overriding principles, in fact, act as absolute constraints on a will’s power in Egypt. These rules prove fundamental to the legal and social fabric of inheritance; they represent non-negotiable limitations on a testator’s freedom. Consequently, a failure to respect these limitations will invariably lead to courts partially or wholly invalidating the will.

The Unwavering One-Third Rule: Core Components of an Egyptian Will

Egypt’s one-third (Thuluth) rule imposes the single most important limitation on the elements of a will in Egypt. Grounded in a well-known Hadith of the Prophet Muhammad, this principle dictates that a testator can only freely dispose of up to one-third of their net estate through a will. The law automatically reserves the remaining two-thirds for legal heirs according to fixed shares it mandates.

Any bequest exceeding this one-third limit is not automatically void; rather, it remains suspended. Its execution, therefore, depends entirely on the unanimous consent of all competent adult heirs, given after the testator’s passing. If even one heir objects, courts enforce the will only up to the one-third threshold. The excess portion returns to the general pool of assets, altering the intended components of an Egyptian will.

Elements of a will The ‘No Will for an Heir’ Principle: Pillars of an Egyptian Will

The prohibition against making a bequest to a legal heir constitutes the second critical limitation. This rule, furthermore, complements the one-third limit by preventing a testator from using their discretionary portion to disrupt the prescribed balance of the mandatory portions. For instance, it stops a parent from giving one child an additional share from the discretionary third.

As with the one-third rule, an exception exists with the unanimous consent of the other heirs. If all other legal heirs agree after the testator’s death, they can validate a bequest to one of their own. This highlights, therefore, that these pillars of an Egyptian will exist primarily to protect the heirs themselves from potential favoritism and disputes.

Advanced Topics Concerning the Elements of a Will in Egypt

Beyond the foundational pillars, several advanced topics prove relevant for comprehensive estate planning. These areas involve the will’s dynamic nature and the application of inheritance principles to modern assets. Therefore, a thorough understanding of these issues becomes essential for robust and future-proof planning involving the elements of a will in Egypt.

Revocation and Modification: Changing the Essential Parts of a Will in Egypt

Its revocability defines a will. A testator has the absolute right to revoke or modify their will at any time during their life, provided they retain the mental capacity to do so. Testators can revoke wills explicitly by creating a new will that clearly states the revocation of all prior wills, or implicitly. For example, an implicit revocation occurs if the testator later performs an act that contradicts the will, such as selling a specific asset. This flexibility is one of the essential parts of a will in Egypt.

Bequeathing Business Assets and Requirements for a Will in Egypt

The principles of Wasiya extend to all forms of property, encompassing business interests and intellectual property rights. A testator can, for instance, bequeath their shares in a company or the royalties from a copyrighted work, subject to the same one-third limitation. However, planning for Business and IP inheritance requires careful consideration of corporate governance documents.

These agreements, notably, may contain clauses that affect the transfer of ownership upon death. As detailed in authoritative guides, ensuring that a will aligns with existing business contracts proves vital to prevent disputes. Therefore, this is an area where the expertise of Top corporate lawyers in Egypt becomes invaluable for meeting the complex requirements for a will in Egypt.

How Alzayat Law Firm Can Assist You

Are you concerned about securing your legacy and ensuring your assets are distributed according to your wishes? The complexities of Egyptian inheritance law, therefore, require precise, expert guidance. This guidance is vital to avoid common pitfalls that could invalidate your will and create conflict for your loved ones. At Alzayat Law Firm, recognized for our international standing by directories such as Global Law Experts, we provide comprehensive estate planning services.

Our Services

- Drafting Legally Compliant Wills: We meticulously craft wills that adhere to all substantive and procedural elements of a will in Egypt. We ensure your document’s validity and enforceability while respecting the mandatory legal framework.

- Navigating Cross-Border Inheritance: For expatriates, we provide strategic advice on the conflict of laws. We leverage our expertise in both Egyptian and international legal systems to create a cohesive estate plan.

- Executing and Registering Your Will: We manage the entire notarization process at the Shahr Aqari. This provides the highest level of legal security and minimizes the possibility of future challenges.

Protecting your family’s future begins with a legally sound plan. Schedule Your Confidential Consultation – Secure Your Legacy Today.

Elements of a will Frequently Asked Questions

General Questions on the Elements of a Will in Egypt

What is a Wasiya in Egyptian law?

A *Wasiya* is the legal term for a will in Egypt. It represents a unilateral, revocable disposition of property that takes effect only after the testator’s death. Its primary purpose, moreover, allows an individual to bequeath up to one-third of their net estate to beneficiaries who are not legally entitled to a mandatory share of the inheritance.

How does an Egyptian will differ from one in a Western country?

The main difference lies in testamentary freedom. In most Western jurisdictions, a person can will their entire estate to whomever they choose. In Egypt, due to the system of forced heirship (*Mirath*) based on Islamic Sharia, a will, however, remains strictly limited to a discretionary portion of the estate, capped at one-third, and generally cannot benefit a legal heir.

What is the most important law governing wills in Egypt?

Law No. 71 of 1946 (The Law of Wills) constitutes the primary statute. This law codifies the essential rules for creating a valid will, including the capacity of the testator, the eligibility of beneficiaries, and the limitations on the bequest. It is the foundational legal text for all testamentary matters in the country.

What happens if a will is found to be invalid?

If a court declares a will invalid—due to a lack of capacity, a formal defect, or a violation of a core principle like the one-third rule—the court sets it aside. The court will then distribute the deceased’s entire estate strictly according to the mandatory rules of forced heirship (*Mirath*) as if no will had ever been written.

Questions for Foreigners and Expatriates

Can a non-Muslim foreigner create a will for their assets in Egypt?

Yes. Under Article 17 of the Egyptian Civil Code, a foreigner’s will and inheritance may fall under their own national law. However, this is subject to the condition that it does not violate Egyptian public policy and that all formal requirements, such as consular legalization and translation, are met.

Does Egyptian law always apply to real estate owned by a foreigner?

Generally, yes. For immovable property (real estate) located in Egypt, Egyptian courts typically apply Egyptian law regardless of the owner’s nationality, following the principle of *lex situs*. This means that even with a valid foreign will, the distribution of Egyptian real estate may still fall subject to local forced heirship rules.

Is my foreign will automatically recognized in Egypt?

No, it is not automatic. A foreign will must prove valid in its country of origin, it must then undergo a rigorous process of legalization through the Egyptian embassy or consulate, and certified translators must then translate it into Arabic for submission to Egyptian courts. We highly recommend consulting with our experts in premier personal legal services.

Questions on Heirs and Beneficiaries

What is the difference between an heir and a beneficiary of a will?

In Egyptian legal terminology, an “heir” (*warith*) is a person the rules of *Mirath* entitle to a mandatory, legally fixed share of the estate (e.g., a child or spouse). A “beneficiary” (*musa lahu*), in contrast, is a person or entity, not a legal heir, a will names to receive a gift from the discretionary one-third portion of the estate. The fundamental rule, therefore, dictates that one cannot be both a mandatory heir and a beneficiary of a will for an additional share without the consent of other heirs.

Can I write a will leaving all my property to one child and not the others?

No. An Egyptian court would void such a will. A child is a mandatory heir and the law already entitles them to a specific share. A will, furthermore, cannot give an additional share to one heir at the expense of another or entirely disinherit a legal heir, as this violates the core principle of *La Wasiya Li Warith*.

Can I leave a bequest to a charity?

Yes, Egyptian law validates and encourages bequests to legally recognized charitable organizations, religious institutions, and other public interest entities. These entities are considered non-heirs, making them permissible beneficiaries of the discretionary one-third portion of the estate.

What if a beneficiary dies before the testator?

If a named beneficiary in a will predeceases the testator, the bequest to that beneficiary typically becomes void. The property that was intended for them would then revert to the main estate and be distributed among the legal heirs according to the rules of forced heirship.

Questions Regarding the Legal Process and Validity

What is the safest way to make a will in Egypt?

The safest and most secure method involves creating an official (notarial) will. This process involves drafting, signing, and registering the will before a Notary Public. This process, therefore, makes the will a public deed and provides the strongest possible evidence of its authenticity, making it extremely difficult to challenge in court.

Is a handwritten will valid if it is not notarized?

A handwritten (customary or *urfi*) will can be valid, but it carries significant risks. Heirs can easily challenge the signature’s authenticity, thus forcing the beneficiary into a lengthy and uncertain court battle to prove its validity. If a challenge successfully disputes the signature, the will becomes worthless.

Do I need a lawyer to draft my will in Egypt?

While not legally mandatory, it is highly advisable. The legal requirements, however, are complex and strict. An experienced inheritance lawyer ensures courts correctly address all **elements of a will in Egypt**, that the language remains unambiguous, and that the document complies with the one-third rule and public order. This dramatically reduces the risk of courts invalidating the will. You can Contact our legal experts for professional assistance.

If all heirs agree, can they ignore the will and distribute the assets differently?

Yes. If all competent adult heirs unanimously agree, they can enter into a formal settlement agreement to distribute the estate in a manner that differs from the instructions in the will or even the mandatory shares. Ultimately, the laws exist to protect the heirs, so their collective, informed consent can override the standard distribution.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Egyptian laws and regulations are subject to change. Always consult with a qualified attorney regarding your specific legal situation.