Banks in Switzerland always remain distinct from others in the countries of the world with their secrecy systems towards depositors’ accounts. And protecting the customer from interference in his private affairs is the first goal of Swiss banking secrecy systems, according to what BBGI Bank stated on its website. And it is noteworthy that the banking secrecy laws that it cherishes Swiss banks, which distinguish them from other international banks, prohibit disclosing the existence of an account without the customer’s consent.

Banks in Switzerland

What are the advantages of banks in Switzerland?

Banks in Switzerland

- In addition to the Swiss banks’ reluctance to verify identity and the origin of deposited funds, the possibility of creating secret accounts with fictitious names or pseudonyms or replacing phrases with hidden numbers known only to the account holder remains.

- Another point that distinguishes Swiss banks is the country’s tradition of generally respecting basic standards of neutrality in various conflicts, including World War II, which explains why wealthy Jewish families and some former Nazis had their ancestry in safety during World War II.

- In addition to being a neutral and open country to the world, Switzerland enjoys remarkable political, economic and social stability.

- Switzerland has the Ombudsman for its Banks, a Zurich-based body that looks into complaints in the event of a dispute, analyzes conflicts between banks and their customers, and offers solutions.

- In Switzerland, it is illegal for banks to identify their customers. If they hand your name over to a foreign investigator or government without legal reason, the Swiss government can sue them for it, so banks in Switzerland are among the best in the world in terms of privacy.

- You will be fully compensated if anything happens to your account, no questions asked.

In some unfortunate cases that result in the loss of your money, such as a natural disaster or a sudden fire, your money will be completely safe and back to you. That’s because the Swiss Banker Association ensures the security of every bank account affiliated with it.

- The safest currencies back Swiss banks in the world

There is almost “zero” inflation with this currency. Why is the franc so stable? The franc is a powerful currency backed by at least 40% of gold reserves.

- A strong economy supports the stability of the country

Not only is the franc fixed, but all of Switzerland has a relatively strong economy. In other words, international economic conflict rarely impacts the Swiss economy. This means that this is where you can bet on the safety of your money.

More information about banks in Switzerland

Indeed, some banks have additional requirements, including proof of income and a minimum deposit. And yes, there are some elite Swiss banks where the minimum deposit can be as high as $100,000. But there are other banks where the minimum deposit is $10,000, which is a fair number for those who want to deposit money in the bank. And in a Swiss bank, you can be sure that your savings are 100% safe.

However, Swiss banks usually charge higher maintenance fees to keep pace with the higher security levels. You should read about all their expenses and weigh the costs and benefits before transferring your life savings to a bank in Switzerland.

- Switzerland has a swiss online bank.

The most important banks in Switzerland

Banks in Switzerland

private banking Switzerland:

Banks in Switzerland where you can safely deposit your money:

Are you looking to open an account in a Swiss bank? Many Swiss banks do not accept applicants from the United States, but there are exceptions to this rule. If you want to protect a Swiss bank from managing your wealth, here is the best:

-

Union Bank of Switzerland UBS

The largest bank in Switzerland, with a significant global presence. A US citizen residing in the United States must contact the Department of Financial Advisors before opening an account with UBS.

-

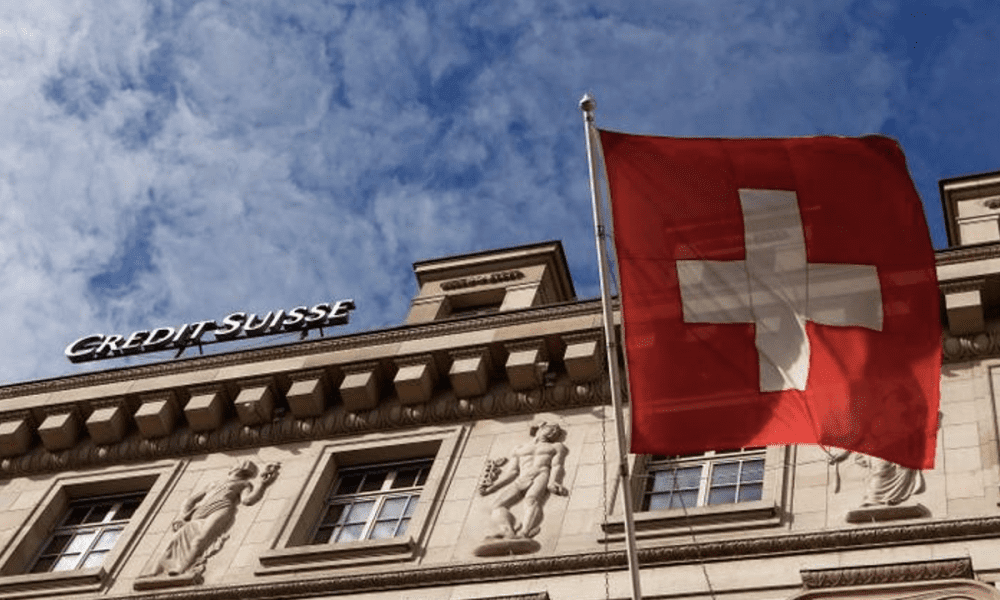

Credit Suisse Group

A leader in financial services, the Credit Suisse Group advises its clients on all aspects of finance. It also provides accounts for individuals and companies and an easy package for start-ups, allowing your company to maintain performance of “5 francs” per month.

It is an investment bank and a diversified financial services company. The head office of the bank is located in Zurich. The bank also offers a wide range of private and investment banking services. Moreover, Credit Suisse is one of the oldest and most prestigious banks in Switzerland, as the bank was established in 1856.

-

CitiBank in Switzerland

Citibank consistently uses a disciplined, modern approach to deliver industry-leading efficiency and returns.

-

Credit Suisse Switzerland

-

Berenberg Bank

It is the oldest commercial bank in the world. The bank was founded in 1590 by the Finnish Berenberg family, specifically Johann Berenberg.

A person who belonged to the ruling merchant elite at that time. Its headquarters is located in Hamburg.

Over the past years, the bank has continued to provide multiple financial and banking services until it reached today to be the sixth-best bank in Switzerland.

Read More: Banks in Egypt: Types and Importance

Banks in Zurich:

- Zurich cantonal bank

The Zurich Cantonal Bank is a milestone in the Swiss banking chain. The bank was founded in 1870 in Zurich, and its owner also belongs to the same town. The excellent banking secrecy distinguished the bank that it grants to its customers, in addition to devising a unique way to protect its customers’ funds by adding a secret number next to the fund’s key, which the customer must enter if he wants to open the fund, which constituted an additional security factor for customers.

- UBS Switzerland

It is one of the most famous and oldest banks in Switzerland. The bank’s divisions include global wealth management, asset management, corporate and individual, and investment banking services.

It offers a full range of commercial banking services to individual and institutional clients.

It has an important feature, which is UBS e-banking Switzerland.

- Geneva private Bank

is also one of the best banks in Switzerland.

- Migros Bank Zurich

One of the best banks that provide excellent services at the lowest prices.

Read more in our website

banks in egypt

Inventory of the succession in Egyptian Banks

Open bank accounts for the heirs

Cheapest offshore bank account in the world